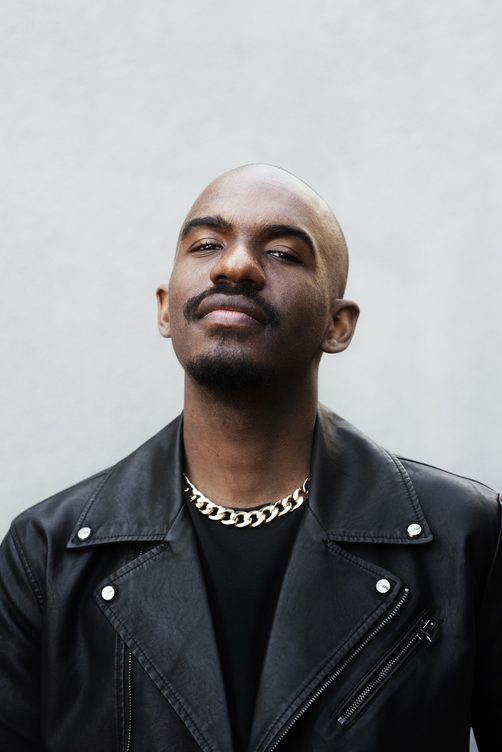

Hakuna stress!

Your path to financial freedom starts here

Download the app today! Get instant loans on your phone with just one tap

Get approved quickly by filling out a simple application and going through our verification process. Your requested funds will be deposited straight into your M-Pesa account for immediate use.

Set up your profile and submit your application today to get a decision in just 10 minutes.

Daviva provides adjustable limits and repayment terms to suit your financial situation. You can borrow any amount between 500 KES and 30,000 KES.

We offer repayment terms from 61 to 122 days, including loan extensions for new customers, and from 61 to 182 days, including extensions for loyal customers. Apply now for hassle-free financial support.

For new customers: from 61 to 122 days, including loan extensions.

For loyal customers: from 61 to 182 days, including extensions.

Apply now for hassle-free financial support!

Representative example for new customers:

1) Loan amounts: from KSH 500 to KSH 30,000

2) MINIMUM loan repayment period: 61 days including loan extension

3) MAXIMUM loan repayment period: 122 days including loan extension

4) MAXIMUM annual percentage rate (APR) excluding stock: 912.5%

If you apply for KSH 10,000 loan for 61 days under 2.5% per day, the total cost of the loan will be KSH 25,250.

No hidden fees - repay the total amount or extend your loan.

Don't stress over repayment. Repay straight from your M-Pesa account via our Paybill number—quick, clear, and hassle-free.

Daviva protects customer personal data in Kenya following the Data Protection Act and adheres to international standards for data protection, specifically ISO 27701, which integrates privacy controls into the broader framework of ISO 27001 for information security. This ensures a comprehensive approach to safeguarding personal data, aligning with global best practices and regulatory requirements.